BIDEN, PERHAPS KNOWING HIS POOR LEADERSHIP IS TO BLAME, RUSHES TO STEM CRITICISM BY ANNOUNCING MAJOR BAILOUTS FOR SVB & SIGNATURE – EVEN AS MORE U.S. BANKS TURN INTO ‘JUNK’ – HOW MANY BANKS CAN BIDEN BAIL OUT WITHOUT KILLING OFF AN ALREADY FLAILING ECONOMY – WHY DIDN’T BIDEN ALLOW AMERICA’S FAMED MARKETS TO CLEAN UP ITS OWN MESS, RATHER THAN USE U.S. TAXPAYERS’ MONEY? – DOES HE HEAR HIS POLITICAL COFFIN KNOCKING AT THE DOOR?

American Capitalism Is Breaking Down – Here’re More Signs The Economy Will Be Really Bad This Year

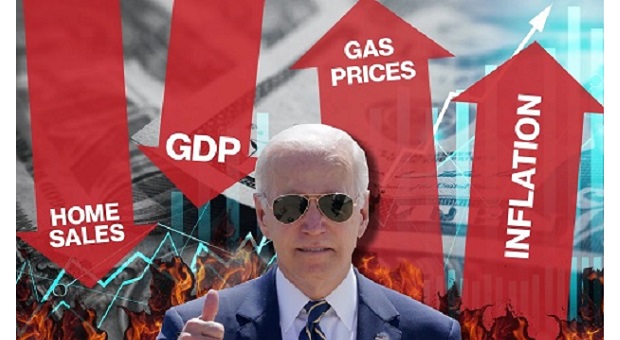

When Biden took office, the U.S. inflation was only 1.4% while the gasoline price was US$2.39 per gallon. Today, inflation is at 6.4% and the gas is US$3.47. And that was after pumping trillions of dollars into the financial system to make sure the system did not crash. After bailing out Silicon Valley Bank, the president assures Americans – “Our banking system is safe.”

But has Biden really fixed the problem? Ken Griffin, founder of hedge fund Citadel, said the rescue package for SVB shows American capitalism is “breaking down before our eyes”. The billionaire, who has grown Citadel to manage US$54 billion in assets, has condemned the U.S. government, saying it should not have intervened to protect all Silicon Valley Bank and Signature Bank depositors.

Griffin argues that the bank’s demise was because the regulator has the habit of falling asleep at the wheel. By bailing out depositors in full, it could set a bad precedent – loss of financial discipline and will never learn the essential of risk management. Of course, he might wish the government hadn’t rescued the banks so that he could scoop their assets at fire sale price.

Regardless whether it was the correct move to bail out Silicon Valley Bank and Signature Bank or not, it’s hard to deny that the American capitalism is breaking down. It was only on February 16 when Forbes ranked SVB as America’s Best Banks for the 5th straight year. Exactly how could the best bank collapsed in a matter of 48 hours, ending its 40-year banking business.

It also raises the possibility of insider trading when SVB CEO Greg Becker sold US$3.6 million of shares in SVB’s parent company on February 27, just weeks before it goes bust – the largest failure since Washington Mutual (US$300 billion in assets) went bankrupt in 2008 during the Global Financial Crisis, which in turn was the most serious financial crisis since the Great Depression (1929-1939).

Credit Suisse saw customer withdrawals of more than 110 billion Swiss francs (US$119.26 billion) in the 4th quarter of 2022, thanks to a string of scandals, legacy risk and compliance failures. The only reason this bank hadn’t collapsed like SVB is because it is much bigger and has 1.6 trillion worth of assets under its management. Still, it is expected to register “substantial” financial loss in 2023.

If the financial trouble plaguing Credit Suisse wasn’t enough to drag down U.S. banking stocks, the news that S&P Global Ratings just downgraded First Republic Bank to “junk” has accelerated the global de-risking. Prior to this downgrade, First Republic Bank and five other U.S. lenders were placed on review for downgrade by Moody’s Investors Service after the demise of SVB.

In fact, Moody’s Investors Service has downgraded the “entire banking system” to “negative” from stable. Despite the U.S. government’s bailout of SVB and Signature Bank, Moody’s was concerned about the risks of unrealized losses or uninsured depositors in other banks. Not only it expects the U.S. economy to fall into recession later this year, but also bets the Fed will continue hiking the interest rates.

Just when “Sleepy” Joe trumpeted that America was experiencing strongest job growth in history under his leadership, Facebook-parent Meta Platforms announced on Tuesday (Mar 14) it would cut 10,000 jobs – just four months after it retrenched 11,000 employees. The tech industry has laid off more than 280,000 workers since the start of 2022, with about 40% of them coming this year.

But the biggest surprise came from Apple, the world’s most valuable company with market capitalization of US$2.4 trillion. In the past, the tech giant typically doled out bonuses and promotions once or twice per year, usually in April and October. Under a new plan, however, employees won’t see bonuses or promotions next month. Instead, it will only happen in October.

The American multinational technology company is also limiting hiring for more jobs and leaving additional positions open when employees leave. Since July 2022, the iPhone maker began its belt-tightening effort due to fear of inflation and recession. And it has managed to avoid the kind of retrenchment like its tech peers, including Facebook and Google.

Now, in anticipation of tougher time ahead, Apple is delaying bonuses and expanding a cost-cutting effort – joining Silicon Valley peers in trying to streamline operations. It is under pressure after revenue declined 5% during the holiday quarter. It becomes so bad that the human-resource department has done something unthinkable – scrutinizing how often employees come to the office.

Some workers are now worried that the increased scrutiny on office attendance is a precursor Apple firing workers who don’t meet the three-days-a-week threshold. Unlike many tech companies, the largest technology company has not announced layoffs, but focus instead on cutting down on hiring. The checking on staff attendance means it is ready to play the last card.

Already, some part-time Apple retail employees have revealed how they are being encouraged to quit by being asked to work more hours and days than they agreed to when they were hired. Chief Executive Officer Tim Cook has taken a pay cut himself, where his compensation for 2023 would fall by more than 40% to about US$49 million. These are really bad signs.

FINANCE TWITTER

.