It will not happen overnight or next month. And it will not lose entirely its reserve currency status next year. But the U.S. dollar is definitely losing its status at a faster pace than generally accepted. Western analysts and economists are simply in denial when they insist that the greenback is not going anywhere, let alone being replaced by the Chinese Renminbi / Yuan.

One can argue that it doesn’t make sense for the Chinese currency to replace the American dollar’s hegemony. In fact, it’s both risky and dangerous to dump one currency in favour of another just for the sake of changing the existing reserve currency. What if China similarly behaves like the U.S. – slapping sanctions to the extent of freezing foreign reserves of any country it doesn’t like?

In actuality, the de-dollarization is not about replacing the dollar with another currency. It’s about diversification or spreading the risk. It’s about reducing reliance on the U.S. dollar as a foreign currency. It’s about strengthening national currencies and reducing vulnerability to American sanctions. It’s about having an option to prevent being held hostage by the U.S.

In truth, the U.S. currency now constitutes about 58% of total global reserves, down from 73% in 2001. The Ukraine War, provoked by the U.S. and its allies NATO in Europe, saw not only financial and economic sanctions imposed on Moscow, but the frozen of Russia’s US$630 billion foreign reserves – effectively emptying its coffers critical to support the rubles. It was a wake up call.

Exactly why you should keep the dollar when your hard-earned national reserve can be easily taken away by the West? After freezing the Russian reserves, the greedy Western power now wants to seize them completely – a daylight robbery – under the pretext of covering the cost of rebuilding Ukraine. Such proposal spooks the world to dump dollar even faster.

But now she isn’t so sure. Over the weekend, Yellen made a U-turn during an interview with CNN, admitting the dollar’s dominance as the global reserve currency is at risk. She finally admits Washington’s imposition of unilateral sanctions on countries around the world could indeed undermine the U.S. dollar. At the same time, to save face, she argues that sanctions are still a very effective tool.

She said economic sanctions imposed on Russia and other countries by the United States are forcing the target nations to seek an alternative. What took her so long to realize the silly mistake when everyone has been warning the U.S. for almost a year? In denial, arrogant Western nations laughed at the idea of the Chinese Yuan replacing the mighty American dollar.

Like it or not, de-dollarization is real and is gaining steam. Even warmonger Republican Senator Marco Rubio has raised his concerns. In a March 30 segment on Fox News, he complained – “We won’t have to talk sanctions in five years, because there will be so many countries transacting in currencies other than the dollar, that we won’t have the ability to sanction them”.

Brazil’s president, Luiz Inacio Lula da Silva, is the latest leader of BRICS who has called for the formation of BRICS currency to replace the dollar in foreign trade. It came after the biggest economy in Latin America announced on March 30 a deal with China to conduct their trade and financial transactions directly – exchanging Yuan for Real and vice versa instead of going through the greenback.

With or without BRICS currency, de-dollarization will continue. The Brazil leader might be throwing a cat among the pigeons. There’s a reason why China and Russia have been stockpiling gold like crazy. The only way to challenge the U.S. dollar is for the challenger to provide a compelling reason why it is a better alternative to the greenback. And that reason is gold.

To understand how important gold is, look no further than Russia. After the U.S. and Europe imposed sanctions, it triggered a massive devaluation of the country’s currency. Russians lined up at ATMs to withdraw their money. The Bank of Russia immediately hiked the interest rates to 20% to slow the withdrawal, as the ruble plunged 30% against the U.S. dollar after the ban of Russian banks from the SWIFT system.

The ruble was trading at 81.16 per U.S. dollar on Feb 23, 2022, the day before Vladimir Putin launched a special military operation to invade Ukraine. About 2 weeks later (March 7), the ruble plunged to its record low of 151 to a U.S. dollar, triggering the nightmare of the 1998 Russian financial crisis. A month later (April 7), however, the currency improved to 79 per U.S. dollar.

The Russian currency was higher than even before the invasion of Ukaine, despite the ongoing sweeping sanctions which supposedly have crippled Russia’s economy. Today, it is trading at 81 rubles to a U.S. dollar. Besides enforcing ruble payments for energy products as well as some capital control measures, Moscow introduced the gold standard to stabilize the ruble.

On March 25, 2022, the Bank of Russia unexpectedly announced that it would link ruble to gold at 5,000 rubles per gram. By pegging the currency to gold, Putin has effectively strengthened the ruble with a gold standard. Meaning he has set a floor price for the ruble in terms of the U.S. dollar since gold trades in the same U.S. dollar. And this is where the fun begins.

Because gold has been trading at about US$62 per gram, it translated to (5,000/62) about 80.6 rubles per dollar. This is why the Russian currency still trades at 81 to a dollar today. By demanding buyers of Russian gas pay using rubles, the country’s natural gas is also linked to gold via ruble. People have confidence in ruble because they can exchange it for gold if they want.

By linking the ruble to gold and then linking energy payments to the ruble, it has not only put a floor under the ruble-dollar rate, hence stabilized and strengthen the ruble, but has actually started the de-dollarization. China saw the results and bought even more gold, as do other countries. Now, imagine members of BRICS replicate the same process, using all their gold reserves to back the new currency.

Without gold, no currency can dream of giving the dollar a bloody nose as all of them are “fiat currency” – currency that is not backed by a commodity, such as gold or silver. Meaning those currencies will lose value over time, largely due to inflation. That’s why the purchasing power of the U.S. dollar declined about 7.4% between 2021 and 2022 alone.

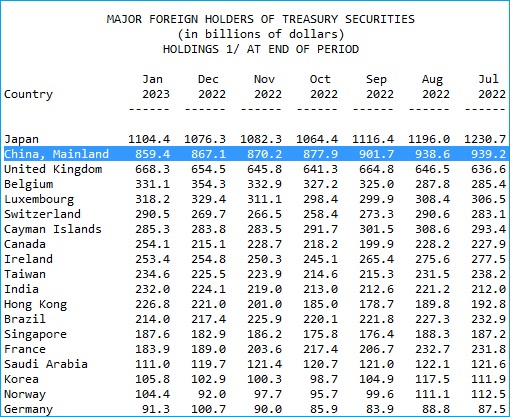

Gold has proven to be the only commodity that has outlasted civilization. China understood this very well, therefore, has been dumping U.S. Treasury. It holds only US$859 billion in January 2023, down from US$1.028 trillion in January 2022. Essentially, Beijing has sold US$169 billion since the Ukraine War started. In exchange, it is loading its reserves with gold.

Two months after freezing Russian foreign reserve, the West happily discussed the possibility of similar sanctions on China in the event of its military invasion of Taiwan. In addition, Chinese enterprises have made about US$145 billion of foreign direct investment (FDI) in the United States and about US$83 billion in the European Union. All these can be frozen by the Western nations.

Of course, China’s economy is 10 times bigger than Russia’s and has plenty of room to take retaliatory actions. For example, it could nationalize Western FDI worth US$1.9 trillion in China. It can also freeze more than US$1.2 trillion of Chinese domestic stocks and bonds owned by foreign investors. Chinese entities have incurred about US$2.7 trillion of external debt mostly in U.S dollar and Euro, which it can stop servicing.

More importantly, America cannot go back to the gold standard because it has been printing too much money that the world is drowning with dollars, so much so the greenback has to be devalued – triggering hyperinflation. As of February 2023, the U.S. currency in circulation was a staggering US$5.321 trillion. But according to the Department of Treasury, it has only 261 million ounces of gold.

Assuming Fort Knox is not empty as suspected by many, it would translate to US$20,300 per ounce of gold if Washington plans to go back to the gold standard. Who would be dumb enough to pay this amount when the gold price today is merely US$2,012 per ounce? The dollar has to be devalued by at least 10 times in order to return to the gold standard, which President Nixon ended in 1971.

The best part is arch-rivals Saudi Arabia and Iran are scrambling to join BRICS. With major oil producers OPEC+ in the BRICS economic group, a new BRIC currency will be even stronger and more attractive as it will be backed by gold and oil. Washington now finally understands why Beijing brokered the peace deal between Saudi and Iran.

It doesn’t matter if the West or G7 nations boycott the BRICS currency. The BRICS nations and other non-Western emerging economies can trade among themselves without dollar, knowing very well the new currency is redeemable for gold or other resources and raw commodities like coal, wheat, grain, nickel or sunflower oil. This is called the New World Order.

A two financial systems in a multi-polar world would see the US dollar backed by American printing machines whilst another currency backed by hard gold. It won’t happen overnight because China still has US$860 billion to dump. Yellen knew the Yuan or BRICS currency does not need to fully dethrone the U.S. dollar. It would already be a disaster if the dollar loses 10% of its market share.

FINANCE TWITTER

.