March 10 (Reuters) – Startup-focused lender SVB Financial Group (SIVB.O) became the largest bank failure since the financial crisis on Friday, in a sudden collapse that roiled global markets and stranded billions of dollars belonging to companies and investors.

California banking regulators closed the bank, which did business as Silicon Valley Bank, on Friday and appointed the Federal Deposit Insurance Corporation (FDIC) as receiver for later disposition of its assets.

The main office and all branches of Silicon Valley Bank will reopen on March 13 and all insured depositors will have full access to their insured deposits no later than Monday morning, the FDICsaid.

But 89% of the bank’s $175 billion in deposits were uninsured as the end of 2022, according to the FDIC, and their fate remains to be determined.

Companies such as video game maker Roblox Corp RBLX.N and streaming device maker Roku Inc (ROKU.O) said they had hundreds of millions of deposits at the bank. Roku said its deposits with SVB were largely uninsured, sending its shares down 10% in extended trading.

Technology workers whose paychecks relied on the bank were also worried about getting their wages on Friday. An SVB branch in San Francisco showed a note taped to the door telling clients to call a toll-free telephone number.

The FDIC said it would seek to sell SVB’s assets and that future dividend payments may be made to uninsured depositors.

At times in the past, the FDIC has moved quickly, even striking deals to sell major banks over the weekend.Report an ad

SVB did not respond to calls for comment.

The bank’s customers were met with locked doors on Friday. A client dashboard was down, a UK-based client of the bank told Reuters.

Dean Nelson, CEO of Cato Digital, was on a line outside of SVB Santa Clara headquarters, hoping to get answers. Nelson said he was worried about the company’s ability to pay employees and cover expenses.

“Access to the cash is the biggest problem for the majority of the companies here. If you’re a startup, cash is king. The cash and the workflow, to be able to have the runway is critical.”

The problems at SVB, which quickly escalated after the bank said on Wednesday it would raise money, underscore how a campaign by the U.S. Federal Reserve and other central banks to fight inflation by ending the era of cheap money is exposing vulnerabilities in the market. The worries walloped the banking sector.

U.S. banks have lost over $100 billion in stock market value over the past two days, with European banks losing around another $50 billion in value, according to a Reuters calculation. Regional banks sold off on Friday.

U.S. lenders First Republic Bank (FRC.N) and Western Alliance (WAL.N) said on Friday their liquidity and deposits remained strong, aiming to calm investors as their shares fell. Others such as Germany’s Commerzbank CBKG.DE issued unusual statements to reassure investors.

Some analysts forecast more pain for the sector as the episode spread concern about hidden risks in the banking sector and its vulnerability to the rising cost of money.

“There could be a bloodbath next week as banks are in trouble, the short sellers are out there and they are going to attack every single bank, especially the smaller ones,” said Christopher Whalen, chairman of Whalen Global Advisors.

U.S. Treasury Secretary Janet Yellen met with banking regulators on Friday expressed “full confidence” in their abilities to respond to the situation, Treasury said.

The White House on Friday said it had faith and confidence in U.S. financial regulators, when asked about the failure of SVB. Cecilia Rouse, who chairs the Council of Economic Advisers, said the U.S. banking system was fundamentally stronger than it was during the 2008 financial crisis.

“The first bank failure since 2020 is a wake-up call,” said Matthew Goldberg, an analyst at Bankrate.

The genesis of SVB’s collapse lies in a rising interest rate environment. As higher interest rates caused the market for initial public offerings to shut down for many startups and made private fundraising more costly, some SVB clients started pulling money out.

To fund the redemptions, SVB sold on Wednesday a $21 billion bond portfolio consisting mostly of U.S. Treasuries, and said it would sell $2.25 billion in common equity and preferred convertible stock to fill its funding hole.

Its stock collapsed and depositors started to panic. SVB scrambled this week to reassure its venture capital clients their money was safe. By Friday, the collapsing stock price had made its capital raise untenable and sources said the bank tried to look at other options, including a sale, until regulators stepped in and shut the bank down.

After the FDIC announcement, employees received an email from the company saying they would be contacted by officials about employment and compensation, according to a source who declined be identified. As of Friday evening, there had not been any further communication from the company or the FDIC, the source said.

The last FDIC-insured institution to close was Almena State Bank in Kansas, on October 23, 2020. – REUTERS

“Worst Since Lehman”: Banks Break The World Again

Well, something just broke…

Things started off badly as SVB crashed 65% in the pre-market before being halted. SVB bonds were puking hard and when the FDIC headline hit, the bonds collapsed further…

Source: Bloomberg

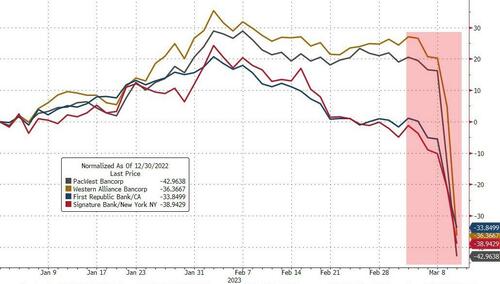

A number of small/medium sized banks were clubbed like a baby seal…

Source: Bloomberg

And the KBW regional bank index crashed (down 9 of the last 10 days and 20% in that period). The 18% drop this week was the index’s worst drop since Lehman (Sept 2008)…

Source: Bloomberg

And as you’ll see below, that started to have some notable impacts on the most arcane of global systemic risk red flag signals…

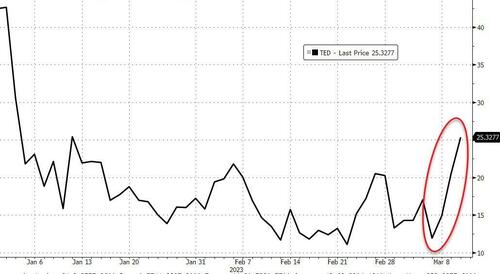

- TED Spread at YTD highs (systemic risk rising)

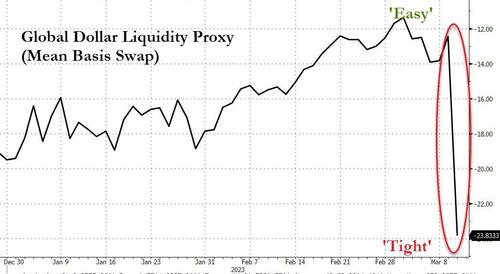

- Global USD Liquidity tightest in 2023 (foreigners paying up for USDollars)

- Global Bank Credit Risk rising

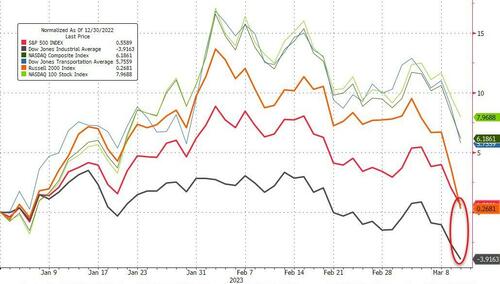

The worst week for stocks in 2023… On the week, all the US majors were down hard with Small Caps crashing 9%, S&P, Dow, and Nasdaq over 4% lower…

The Dow has been underwater on the year for over a week and is now down 4% in 2023. Today’s ugliness smashed the S&P 500 and Russell 2000 down to unchanged on the year…

Source: Bloomberg

All the US Majors are now back below their 200DMAs…

Unsurprisingly, financials were the week’s biggest sector laggards but all were red on the week…

VIX exploded higher on the day, back above 28 and recoupling with equity weakness…

Source: Bloomberg

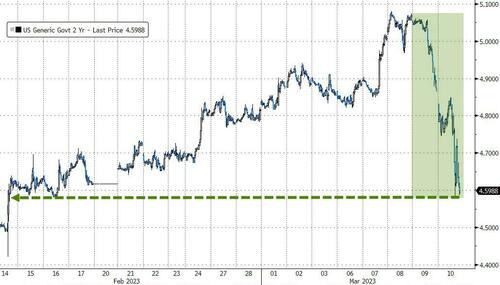

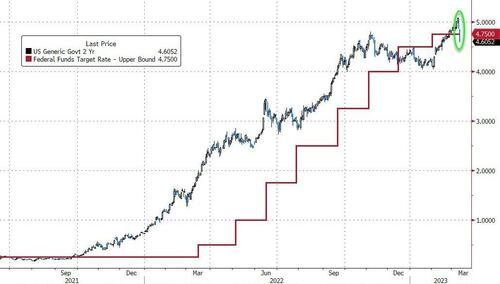

On the week, Treasuries saw a wild ride but yields ended dramatically lower across the curve with the shorter-end outperforming (down almost 30bps on the week)…

Source: Bloomberg

The 2Y yield is down over 50bps in the last two days, the biggest 2-day drop since Lehman (Sept 2008)…

Source: Bloomberg

The 2Y Yield is back below the Fed Funds rate once again, and will likely be considerably further below it after the next Fed meeting…

Source: Bloomberg

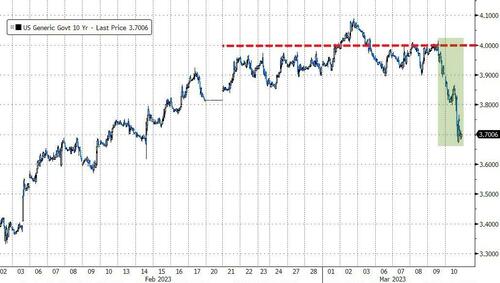

The 10Y yield puked back to 3.70% – one month lows – after testing 4.00% for two weeks…

Source: Bloomberg

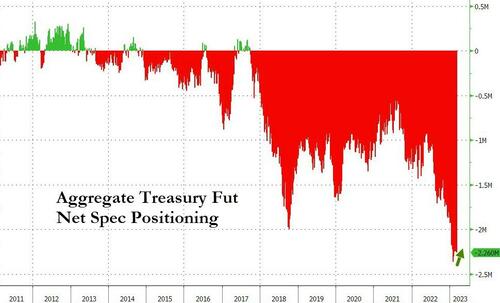

Notably, Specs are practically still at their most short ever in bonds – so this week’s plunge in yields was hurting a lot of people…

Source: Bloomberg

No extreme moves in the TED spread yet (although its back YTD highs as systemic risk increases)…

Source: Bloomberg

Global bank credit risk is on the rise too…

Source: Bloomberg

The dollar ended higher against its fist peers on the week – after major ups (hawkish Powell) and downs (SVB sparking dovishness)…

Source: Bloomberg

Global dollar liquidity tightened dramatically this week as the world reached for USDs at much more aggressive costs…

Source: Bloomberg

Bitcoin puked back down to $20,000 – 2 month lows – and found support…

Source: Bloomberg

Solana and Litecoin were hit really hard this week with BTC and ETH down about 10% and Ripple holding close to unch…

Source: Bloomberg

Against all the carnage, bullion joined bonds in the safe-haven camp, with gold spiking back above $1870 – one month highs…

While oil was up today, WTI ended lower on the week back to a $76 handle…

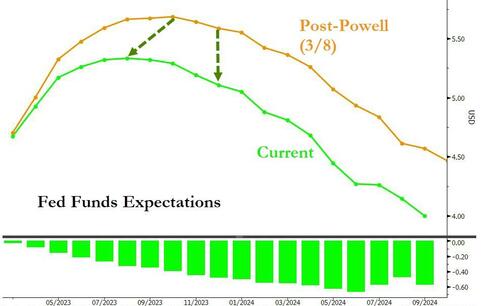

The ‘panic’ across markets had a dramatic effect on Fed rate trajectory expectations with the Fed’s terminal rate expectations plunging over 55bps since the post-Powell spike earlier in the week, and 40bps of rate-cuts are now priced-in by year-end…

Source: Bloomberg

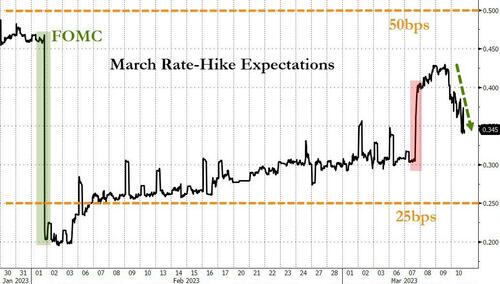

Additionally, expectations for The Fed’s action in March are hawkishly higher on the week (but down today) with around a 40-50% chance of 50bps hike priced in…

Source: Bloomberg

To put that shift in context, the term structure has dropped and twisted significantly since Wednesday…

Source: Bloomberg

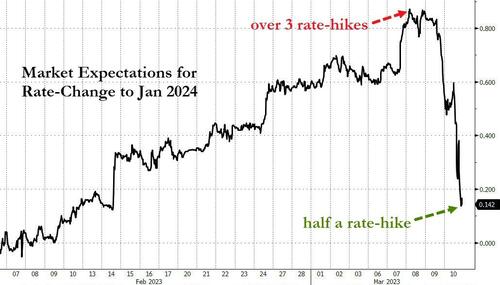

Just to really rub in what the fuck just happened… the market was pricing in over 3 25bps rate-hikes to Jan 2024 on Wednesday… and now its pricing in around half of one rate-hike…

Source: Bloomberg

Finally, we give the last word to Eric Johnston at Cantor Fitzgerald:

“Three days ago the view in the market was that economy was teflon vs the rate hikes and that there were not going to be any financial accidents because we have made it this far without much damage,” he wrote.

“What has now changed is that people now realize that we are not teflon and there can be impact and very negative impact at that from these hikes. It is not about which bank is next, or who has similar exposure, or will depositors be made whole. It is about there likely being more time bombs out there that we have no idea about right now. That is what has changed, people no longer believe we are teflon…finally.”

Maybe keep your eyes out for other bank CEOs dumping millions in their own stock…

Makes you wonder eh?

Returning full circle to the start of today’s market summary, we are reminded of Michael Hartnett’s closing remarks: “The market stops panicking when central banks start panicking.” – ZERO HEDGE

REUTERS / ZERO HEDGE

.