WAH! LOOKS LIKE SINGAPORE ‘SAPU BERSIH’ IN BEIJING – COMPLETES ‘SUBSTANTIAL NEGOTIATIONS’ ON FTA UPGRADE WITH CHINA – ‘ONCE SIGNED, THE PACT WILL BECOME CHINA’S FREE TRADE PACT OF THE HIGHEST OPENING-UP LEVEL TO DATE’

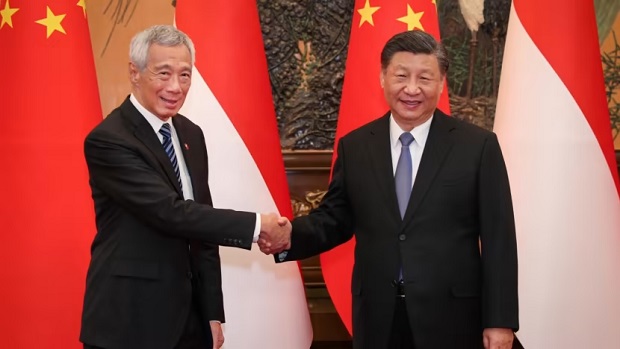

China and Singapore have completed “substantive negotiations” on the upgrade of bilateral free trade agreement (FTA), which will improve market access for each other’s businesses and provide for more transparent and higher-level economic rules. The announcement comes a day after both sides agreed to upgrade bilateral relations to an “All-Round High-Quality Future-Oriented Partnership” during Singapore’s Prime Minister Lee Hsien Loong’s visit to China.

The pact, once signed, will become China’s free trade pact of the highest level to date, observers said, demonstrating that economic ties between China and Singapore are on the course of upgrading to a new height, amid both countries’ steadfast multilateral push for ASEAN regional integration and the latter’s resistance to taking sides between China and the US under stepped-up US decoupling attempts.

The FTA upgrade will accelerate the ongoing negotiation for the 3.0 version of the China-ASEAN free trade agreement (ACFTA 3.0)and the further upgrading of the Regional Comprehensive Economic Partnership (RCEP) – both of which serve as catalysts to ASEAN regional integration and prosperity-providing a beacon for opening-up standards. It is also poised to lay an institutional foundation for China’s application to join the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), which Singapore is also a member.

China and Singapore on Saturday have signed a Memorandum of Understanding on the substantial completion of the upgrade on the China-Singapore Free Trade agreement, under the witness of Chinese Premier Li Qiang and Lee, according to a statement on the website of China’s Ministry of Commerce (MOFCOM).

It marks the first time that China, in FTA practice, made dual opening-up commitments in both services and investment under the negative list approach, the statement said. Previously, the world’s largest free trade agreement RCEP which entered into force last year, was the first time that China made investment openness commitment in the form of a negative list under FTA.

On the foundation of original FTA agreement, the new pact will improve opening-up standard in services trade, and investment, it also includes chapters concerning the telecom industry, and incorporate high-level economic and trade rules such as national treatment, market access, transparency and digital economy, the statement noted.

Both sides also reached consensus that they won’t retreat from opening-up measures, and made pledges on “the doors to each other will open wider” through the agreement.

“The deal is an important measure and a practical action in China’s aligning with high-level international economic and trade rules and the expansion of opening-up. It will significantly boost China-Singapore economic and trade cooperation to a new level,” MOFCOM said.

Observers said that the upgraded FTA is of great significance to both sides, as it is based on solid political trust and stems from the fundamental interests of the two countries. It is also a fresh effort of both economies to deepen the development of regional trade liberalization.

“Singapore has been crowned as one of the world’s most open economies …So China’s FTA upgrade with Singapore could be regarded as a trial in the former’s further opening-up in terms of standard-making,” Tu Xinquan, dean of the China Institute for WTO Studies at the University of International Business and Economics in Beijing, told the Global Times on Sunday.

For Singapore, upgrading the FTA with China also has a consideration in geopolitics and geo-economy. Singapore is increasingly finding that it has little to gain from going any further with the US, nor could it be able to negotiate with the US on an equal footing, Li Yong, deputy chairman of the Expert Committee of the China Association of International Trade, told the Global Times on Sunday.

Against the backdrop of global trade that has been compounded by geopolitical tensions, the FTA upgrade also sends out a clear message that ASEAN economies such as Singapore continue looking to forge closer cooperation with China despite US-instigated decoupling calls,” Tu added.

China and Singapore have been joining hands in facilitating regional integration and supply chain stability, as exemplified by the implementation of RCEP and the creation of the New International Land-Sea Trade Corridor, a major trade channel between western Chinese provinces and ASEAN members.

Singapore Prime Minister Lee concluded a six-day official visit to China on April 1. The country has been China’s largest foreign investor since 2013, and China has also been the largest trading partner of Singapore for nine consecutive years.

Ong Tze Guan, chairman of the Singapore Chamber of Commerce and Industry in China, told the Global Times that “both Singapore and China will benefit from the multiplier effects of synergies brought about by improvement of overall economic, trade, and investment relations in the region, with the resumption of connectivity and people-to-people exchanges …Coupled with stability and economic prosperity in the region.”

In 2008, China and Singapore signed FTA, and it was China’s first comprehensive bilateral FTA concluded with an ASEAN economy. Both sides upgraded the FTA protocol in 2018, and a further upgrading talk started in December 2020.

The MOFCOM statement said that in follow-up works, teams from both countries will continue the review and translate the legal document involving FTA upgrade, implement domestic procedures of respective country, and strive to sign the pact as soon as possible.

Accelerating ASEAN integration

On Saturday, Chinese Premier Li held talks with Lee in Beijing. Noting China always regards the ASEAN as a priority of neighborhood diplomacy and firmly supports the centrality of ASEAN, Li said China is ready to work with ASEAN countries including Singapore to promote the construction of ASEAN-China Free Trade Area (ACFTA 3.0) and advance regional economic integration.

Observers said that the China-Singapore FTA upgrade will play a demonstration effect in driving other ASEAN members to fast track the negotiation process. “The differences in development stage between ASEAN economies have posed certain barriers … So the FTA could also offer a set of standards for reference, in particular new provisions involving digital economy and data,” Tu said.

The first round of consultations on version ACFTA 3.0 negotiations started on February 7.

Xu Ningning, executive president of the China-ASEAN Business Council, told the Global Times that ACFTA 3.0 will expand the scope of cooperation into broader areas of mutual concern such as the digital economy, green economy and supply chain linkage.

“It will speed up the construction of a closer China-ASEAN community of shared future and attract more international companies to invest in the FTA,” Xu said.

Li Yong said that the FTA upgrade between China and Singapore provides a model for future RCEP upgrade. The RCEP definitely needs to be improved for further regional openness, and the upgrade of the China-Singapore FTA may be a precursor, he noted.

Such efforts are also markedly different from Washington’s, who has been erecting barriers everywhere with the sinister motivation to suppress Beijing. The US has been trumpeting the Indo-Pacific Economic Framework for Prosperity (IPEF), a geopolitical tool aiming to contain China in the Asia-Pacific region.

Analysts pointed out that the IPEF amounts to an “empty promise,” as it does not possess the characteristics of standardized FTA arrangements in market access and tariff issues. Nor is the US willing to pump up investment to deepen regional trade. GT

China is best safe haven; global investors shouldn’t miss out because of politics

For months, China’s swift economy recovery has been making headlines around the world, often portrayed as the only “bright spot” across a slowing global economy. But what does such a recovery look like? What does it mean for global investors? There was no clear, full picture, and there were some doubts, especially in foreign media.

But, a growing number of recent signs suggest that the pace of the recovery in the world’s second-largest economy is faster than many have expected. In March, the purchasing managers’ index (PMI), a gauge of factory activity, beat some economists’ forecasts and reached 51.9, well within expansion territory. What’s more, the PMI reading for the non-manufacturing sector jumped to 58.2.

And things may be just getting started. Following the two sessions, where China set an annual GDP growth target of about 5 percent this year, Chinese officials at all levels have moved swiftly to further speed up the economic recovery, with a series of policy measures. On Friday, Zhu Zhongming, a vice minister of finance, said China will step up fiscal support for the economy, including tax and fee reductions for businesses. The extended and optimized tax and fee cuts are expected to reduce more than 480 billion yuan ($69.9 billion) in costs for market players.

What’s more, various central government departments and local governments have also launched what appears to be a nationwide campaign to improvement business climate for businesses. Just over the past several days, provincial governments from Northeast China’s Liaoning Province to South China’s Hainan Province held special meetings for the effort.

All of this points to an optimistic picture for China’s economic recovery. Amid the growing signs of rapid recovery, the World Bank, in a report on Friday, raised its forecast for China’s growth by 0.6 percentage point to 5.1 percent in 2023. Some context will help better grasp the scale of China’s recovery this year. For the Asia Pacific, growth excluding that of China will slow to 4.9 percent this year, down 0.9 percent point from 2022. For the world economy, growth will average 2.2 percent throughout the rest of the decade, according to the World Bank. So, from every aspect, China’s growth will be the bright spot for the world economy – and an ideal market for global businesses seeking growth.

And that’s not all. While China is on a stable trajectory toward recovery, advanced economies like the US and the eurozone are facing both significant slowdowns and the risk of financial and banking crises. The collapse of Silicon Valley Bank and some other banks in the US and the failure of Credit Suisse in Switzerland exposed the profound risks in the Western banking system. While Western officials have repeatedly claimed that a broader crisis is not imminent, investors are understandably jittery and in desperate need for viable options to cushion the risks in advanced economies. And where they could find such options? One word: China.

There is no shortage of fearmongering headlines pushed by the Western media reports about China’s economy. Their assertion is often based on hearsay or outright lies. They claimed that China is increasingly “hostile” to foreign businesses and many foreign businesses are abandoning the Chinese market. But they ignored the steadily increases in foreign investment into China, even during the toughest period of the epidemic. In 2022, foreign direct investment into China grew 6.3 percent to 1.23 trillion yuan. That doesn’t exactly look like a “mass business exodus” from China, does it?

Also, there are the ever growing calls for “decoupling” or “reducing reliance” from US and other Western officials, asserting that it is unsafe for foreign businesses to invest in China. But for any fair-minded person, it should crystal clear which country is making it unsafe for cross-border investments. In a desperate attempt to preserve its shrinking global dominance, the US is picking fights, economic or otherwise, around the world. It is adopting protectionist policies at home to bolster its domestic industries. Externally, it is imposing unilateral sanctions on any country it deems to be unfriendly. Worse yet, it is now exporting risks of financial and banking crises to the world.

Many multinationals are fully aware of what is actually happening on the ground. And if there was any doubt about China’s continuously expanding market access and improving business climate for global businesses, face-to-face meetings with Chinese officials at two major forums – China Development Forum and the Boao Forum for Asia – should offered sufficient reassurance. For businesses around the world that seek win-win cooperation, don’t miss out on China just because of geopolitical ramblings in the US. – GT

GLOBAL TIMES

.