DON’T BE TOO HAPPY, TRUMP! U.S. STOCK MARKET HITS NEW RECORD HIGHS – BUT FARM BANKRUPTCIES JUMP TO HIGHEST SINCE 2011

Investors, speculators and punters were cheering as the U.S. stocks hit fresh record highs on Friday on hopes for a US-China trade deal despite mixed economic data. The Dow Jones Industrial Average (DJIA) holds above 28,000 points on Monday, after the index hit the level for the first time after posting a fourth straight week of gains.

It appears the stock market didn’t care about the impeachment that President Trump is currently facing. The optimism was encouraged, largely, by a potential trade deal between the world’s two biggest economies, never mind that the “Phase-1” negotiations increasingly sound like an empty rhetoric. The U.S. president reportedly isn’t ready to sign off the deal, despite him blowing his own horn earlier.

Some said – and hope – the Phase-1 trade deal, agreed by both nations in early October, could be signed before Christmas this year. But don’t hold your breath though. The Chinese government said earlier this month that the U.S. and China had reached an agreement to roll back tariffs imposed on each other’s products.

A week ago, however, President Trump said that he has not agreed to scrap tariffs on Chinese goods, contradicting the signal from China. At the same time, Trump has demanded China buy up to US$50 billion in U.S. agricultural products annually. China, reluctant to commit, argued that it would only make sense to allow market forces dictate purchases after tariffs are lifted.

Indeed, agriculture is one of the issues that the Trump administration has to tackle. When the trade war began in July 2018, where the U.S. imposed US$34 billion in tariffs on Chinese goods, Beijing immediately retaliated by slapping a 25% tariff on soybeans, along with taxes on other agricultural products. After rounds of retaliations, soybean tariffs today is as high as 33%, while pork tariffs as high as 72%.

Things have gotten worse for American farmers. At the peak of the US-China soybean trade, farmers in North Dakota were sending 80-90% of their soybeans to China. Now, it’s gone. Despite having rained US$28 billion in aid, the farmers continue struggling. The bailout money is already more than twice as expensive as the 2009 bailout of Detroit’s Big Three automakers, which cost taxpayers US$12 billion.

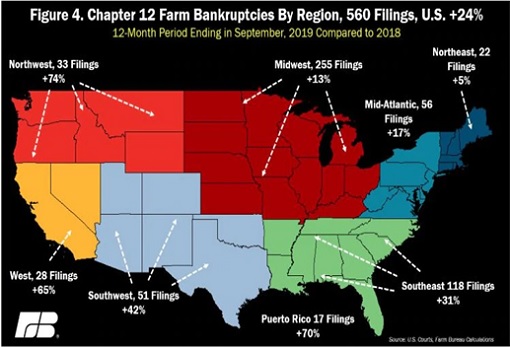

Yes, while the U.S. stock market is soaring to new record highs, American farmers are having trouble paying their bills. According to a recent report from the American Farm Bureau Federation, 580 farms filed for bankruptcy between September 2018 and September 2019 – a 24% increase from the previous 12-month period, and the highest number of bankruptcies since 676 farms filed in 2011.

As a result of falling incomes, the agricultural sector saw the Chapter 12 bankruptcy filings in Wisconsin (highest with 48 filings), followed by 37 filings each in Georgia, Nebraska and Kansas. Six other states – Iowa, Maryland, Minnesota, New Hampshire, South Dakota and West Virginia – also hit 10-year highs for bankruptcy filings this year.

In addition, farm incomes are falling in Colorado, Oklahoma, Wyoming, and portions of western Missouri and northern New Mexico. But not all of the bankruptcies were directly linked to Trump’s trade war with China. The exact cause of bankruptcies was due to a combination of factors, ranging from floods, prolonged periods of freezing weather, droughts, and of course – trade war.

American farmers have actually been struggling to escape a downturn that began in 2013, a slump made worse by Trump’s trade war with not only China but also Mexico and Canada. For example, Richard Blaine, an Oregon apple farmer who filed for bankruptcy in October, said that his farm’s downturn started in 2014 when Russia annexed the Crimean peninsula in Ukraine.

When Western countries imposed sanctions on Russia, Moscow fought back by stopping imports from those countries. European apple producers had to find other markets for their fruit after losing the Russian market, and in the process compete directly with American farmers’ for market share. As Mr. Blaine’s farm started recovering, came Trump with his trade war.

President Trump’s trade wars forced major apple-importers like Mexico, India, and China to raise tariffs on American apples, making the fruits too expensive for export. In Iowa, where about 85% of the land is used for farmland and is ranked first in U.S. egg and corn production, the debt of its farmers reached US$18.9 billion in the second quarter – the highest level in the nation.

According to Iowa State University report, despite Donald Trump’s multi-billion-dollar farm assistance packages to offset losses due to the trade war, Iowa farmers continue to see their financial condition deteriorate, with 44% of producers last year struggling to cover their bills. Apparently, the bail out money has only slowed – not reversed – the trend of financial decline for farmers.

To make ends meet, American farmers have to lower costs, restructure debt, free up cash and even sold equipment and land. U.S. farm debt is projected to reach a record high of US$416 billion, according to the U.S. Department of Agriculture. Adjusted for inflation, the current farm debt is just below record US$431.6 billion in 1980, just before the 1980s farm crisis exploded.

Clearly, farmers have become collateral damage in Trump’s tit-for-tat tariff war with China. Hence, if the president agrees to sign the so-called “Phase-1”, the Chinese must buy up to US$50 billion in U.S. agricultural products every year. The problem with such condition, however, is that the highest amount of agricultural products Beijing ever purchased from the U.S. in a year was US$16 billion.

At most, China is willing to buy US$20 billion worth of agricultural products in a year, if a trade deal is signed. It would only consider boosting purchases further in future rounds of talks, as part of its bargaining chip. Whether the Chinese will boost its purchase to between US$40 billion and US$50 billion would depend on Trump removing remaining punitive tariffs.

So, China actually can buy up to US$50 billion of American agricultural products but to do so will involve sacrificing or offending other trading partners like Brazil and Argentina. Essentially, that would mean putting all the eggs in a basket – an extremely foolish and risky business decision. Therefore, a US$50 billion guarantee is almost unlikely, if not impossible.

Thanks to Trump’s trade war, China has realized that food security means having diversification of sources. The recent African Swine Fever (ASF) has destroyed as much as 60-70% of the country’s pigs, and slashed roughly 25% of its pork production. Beijing can always say that it has fewer pigs to feed now, so they don’t need so much American soybeans and corn.

Perhaps China can purchase more American pork as a trade off for soybeans, corn and other agricultural products. But Trump’s impeachment case gives Beijing the excuse to drag its feet. Besides, the more Donald Trump wanted the Chinese to purchase American agricultural products, the more Beijing believes they have nailed the desperate U.S. president.

Trump, meanwhile, wants China’s unfair trade practices, forced technology transfers and intellectual property (IP) theft to be dealt within one package, together with more Chinese purchases of U.S. agricultural goods. He can throw more money to help the farmers. But with 40% of farm income expected to come from government aid, it has raised concerns about misuse of funds.

Sure, at the start of the trade war, farmers largely view the trade disruption as short-term pain for long-term gain. Most of them were prepared to sacrifice income for a while on the belief they’ll make up for it down the road. They were eager to see their president punish the Chinese. But with bankruptcy cases skyrockets, how long could they wait for China to surrender?

– Finance twitter

.